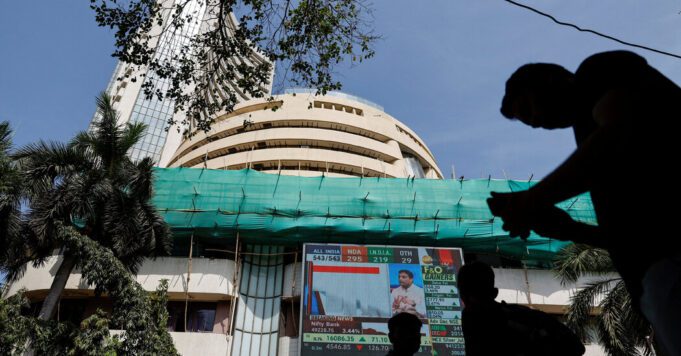

Traders in Mumbai were in for a surprise at the start of the day as India began counting votes for a seven-week election and it became clear that the government of Narendra Modi was performing far worse than expected. By the end of trading on Tuesday, stocks were down 6%, nearly wiping out their gains for the year.

Indian stocks have been soaring, driven by economic growth and confidence that Narendra Modi, the most powerful prime minister in generations, will be re-elected for a third term. Investors eye India Hungry for political stability, many did particularly well during the first decade of Modi’s pro-business leadership. Even after Tuesday’s decline, the blue-chip Nifty 50 index has nearly quadrupled since Modi became prime minister.

But with the election approaching, India's main stock indexes have been volatile.

Some companies, those seen as “Modi stocks,” have fared particularly badly after the election results. The fate of the Adani Group was always the most dramatic. Gautam Adani quickly became Asia’s richest man as his infrastructure-oriented businesses dovetailed with Modi’s plans for India. Short Seller Report at the beginning of 2023 The Adani Group was accused of market manipulation and accounting fraud.

Adani’s shares plunged but recovered within a year as the Indian government and several large global banks’ patience with the company set in. On Tuesday, the group’s flagship company, Adani Enterprises, lost 19% of its value, falling between the peak and the subsequent trough.

Regardless, Modi has won enough seats to form a new government, though his majority is much smaller than expected. Chris Wood, head of global equity strategy at investment bank Jefferies, predicted last year that Modi would have a worse outcome, telling an investor summit in October that if Modi were to suddenly lose, “I’d expect a 25% correction in the stock market, maybe more.”

Professional investors, at least, would probably welcome some degree of correction. Much of the market’s recent growth reflects an influx of small, local investors who are buying stocks for the first time.

As global investors scramble to snap up India’s long-term prospects, it’s almost impossible to find bargains. India has become “everyone’s favorite market,” said Christine Phillpotts, emerging markets portfolio manager at Ariel Investments in Chicago. That means there aren’t many opportunities left, although she agrees that India’s economy will continue to grow strongly.

Another consolation is that while investors need to know which government policies will benefit which companies, India's track record shows that the economy can grow rapidly under a vibrant multi-party democracy. The fastest economic growth in India's history was achieved during the last coalition government, during the peak period of 2006 to 2010.

Even Wood, who had expected stocks to fall as Modi’s approval ratings fell, believes “the stock market will rebound sharply” due to the momentum of India’s overall economy.